Siloed customer data across departments creates a blind spot when it comes to understanding the customer journey and their needs.

Rising competitors and customer expectations create a two-pronged challenge for finance companies: acquiring new customers and keeping existing ones engaged.

Stricter data privacy regulations and increasing cyber threats require robust data management and security solutions to ensure compliance and build customer trust.

Acquiring customers is just the beginning. The key is to leverage data to personalize loyalty programs, identify upselling opportunities, and unlock customer potential for long-term value.

The digital revolution demands a shift in FSI customer engagement. A CDP unlocks a unified view of your customers, revealing goals, risk profiles, and preferences beyond basic demographics. This empowers business to personalize financial plans, predict churn, and identify upselling opportunities.

By tracking every touchpoint and interaction across the client lifecycle, business can provide timely, relevant advice that aligns with clients' financial objectives. This capability not only boosts client engagement but also fosters trust and loyalty over time.

CDP enables financial institutions to deliver personalized experiences across various channels, including online portals, mobile apps, and chat platforms. Through smart automation and rule-based systems, finance professionals can engage clients proactively, ensuring consistent and convenient service delivery regardless of the channel used.

Fostering long-term financial relationships is paramount in the finance industry. By enabling finance professionals to nurture client relationships through tailored financial advice, proactive communication, and value-added services, CDP helps promote financial wellness and cultivate advocacy among satisfied clients.

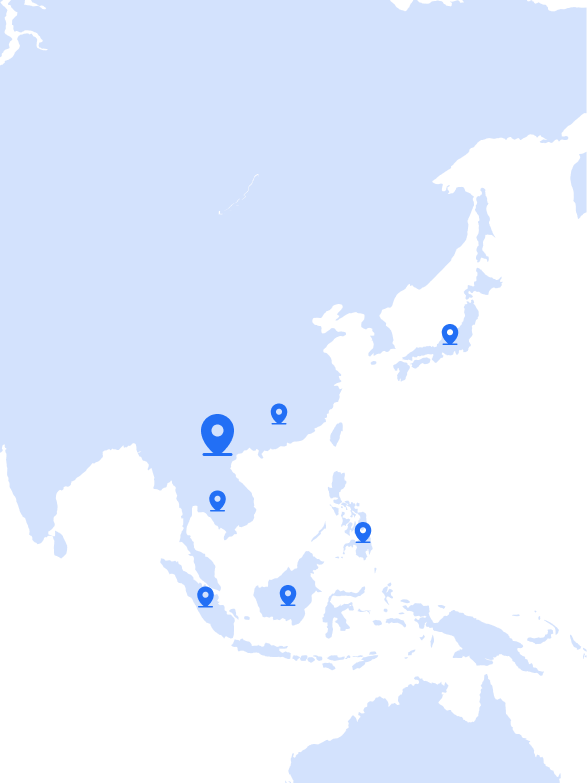

Mobio thrives in the banking sector, serving almost one-third of the Vietnamese market. Our confidence stems from providing highly effective, tailored solutions for each bank's unique needs. Ready to embark on your digital transformation journey?

Leave your email, and we'll guide you through every step.

I agree to Mobio Privacy Policy*

MOBIO needs the contact information you provide to contact you about our product & services. You may unsubcribe at anytime. For more information on how to unsubscribe & our privacy practises, please review our privacy policy.

Thank you for subscribing! From now on you’re the first to receive our newsletter and up-to-date industry news!

Feel free to request a demo to see how our product works!

Due to the highly confidential nature of banking, we are unable to publicly share client case studies. But hey, drop your contact details here, and let's chat about crafting solutions that fit your industry like a glove.

I agree to Mobio Privacy Policy*

MOBIO needs the contact information you provide to contact you about our product & services. You may unsubcribe at anytime. For more information on how to unsubscribe & our privacy practises, please review our privacy policy.

Thank you for subscribing! From now on you’re the first to receive our newsletter and up-to-date industry news!

Feel free to request a demo to see how our product works!